Live or Invest in Florida 0.22 Acres of Treed Land for $199/Mo!

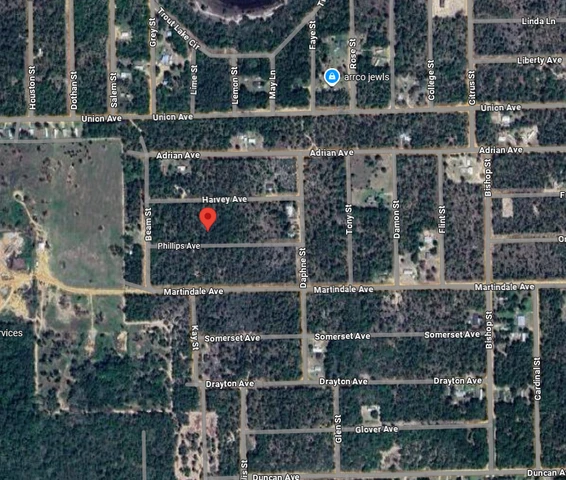

Interlachen, FL | Lat/Lng: 29.6807, -81.8484

$8,199

0.22 ac.

09/11/2025

ACTIVE

Description

Enjoy the best of both worlds! Peaceful rural living with quick access to major Florida cities like Ocala, Tampa, Orlando and Jacksonville on 0.22 acre in Putnam, FL. Located on Norman Ave, this parcel offers excellent road access and is perfectly zoned for residential, single-family homes, with mobile homes and camping permitted. Imagine weekend getaways or daily commutes that are completely manageable, while still coming home to your private oasis among the trees.

Theres something for everyone nearby! Let the well-maintained roads lead you to nearby attraction like Ravine Gardens Ste Park, Riverfront Park, and the globally loved France and Japan Pavilions at EPCOT. Whether youre into hiking, boating, or theme park adventures this is the property for you. We offer flexible payment plans to fit any budget, and you can secure this lot today for just $199/mo with easy owner financing. Send us a message today to get more information.

Property Details:

APN: 25-09-24-4075-0850-0040

Subdivision/Block/Lot: INTERLACHEN LAKES ESTATES/62/22

County: Putnam

State: FL

Size: 0.22 acres

Road Surface: Dirt

Closest Major Cities: Gainesville, Ocala, Tampa, Orlando, Jacksonville.

Zoning: Residential, single-family

Price:

Cash Price: $8199 + $249 Doc fee

OR

Owner Financing:

$149 down with $249 doc fee then $199 per month for 60 months

Why You Should Invest: Building Wealth and Securing Your Future

Investing is a fundamental pillar of building long-term wealth and achieving financial security. By allocating money into assets that have the potential to grow over time, investors can outpace inflation, generate passive income, and build a safety net that protects against economic uncertainty. Unlike saving money in a traditional bank account where returns are minimal and often unable to keep up with the rising cost of living, investing offers opportunities for meaningful financial growth. The power of compound interest means that the returns you earn each year can generate their own returns, creating a snowball effect that accelerates wealth accumulation. This makes early and consistent investing essential; even modest investments can grow into significant sums over decades. Moreover, investing allows you to diversify your income streams beyond just a salary or wages, reducing dependence on a single source of income and providing financial resilience against job loss or economic downturns. Whether you choose stocks, bonds, mutual funds, or real estate, investing is an effective way to make your money work for you and to create opportunities for financial independence and early retirement.

Diverse Investment Opportunities and Risk Management

Another key reason to invest is the wide range of opportunities available, allowing investors to tailor their portfolios to their financial goals, risk tolerance, and time horizons. The financial markets offer a variety of assets, from equities that provide ownership in companies to fixed-income securities that offer steady interest payments, to real estate and commodities that add tangible value. Each asset class comes with its own risk and return profile, which enables investors to build a balanced portfolio designed to weather market volatility. For instance, while stocks may offer higher growth potential, they are often more volatile; bonds tend to be more stable but provide lower returns. Real estate investments not only offer potential appreciation but also cash flow through rentals, and come with unique tax advantages. Through diversification spreading investments across different assets, industries, and geographies investors can reduce the impact of a poor-performing investment on their overall portfolio. Risk management is critical in investing, and understanding how to allocate assets properly is essential to protecting and growing your wealth. Additionally, the rise of digital platforms and robo-advisors has made investing more accessible than ever, removing many traditional barriers such as high minimum investments or complex financial knowledge, enabling more people to participate and benefit from investing.

Financial Independence, Legacy, and the Power of Time

Investing is not just about growing money; its about securing your future and the future of those you care about. Through consistent investing, individuals can build a substantial nest egg that provides financial independence freedom from living paycheck to paycheck and the ability to make life choices without financial constraints. It empowers people to retire comfortably, pursue passions, and provide for family needs such as education, healthcare, and emergencies. Moreover, investments can create generational wealth, passing down assets to children and grandchildren, helping future generations achieve better financial footing and opportunities. The power of time is the greatest ally to any investor; the earlier you start, the longer your money has to grow, and the more you can benefit from compounding returns. Even after market downturns, history has shown that markets tend to recover and grow over the long term, rewarding patient and disciplined investors. Therefore, investing wisely is a way to build lasting wealth, protect against inflation, and achieve personal and family goals. It transforms money from a static resource into a dynamic engine for growth and security.

Details

County: Putnam

Zipcode: 32148

Property Type One: Recreational Property

Property Type Two: Residential Property

Property Type Three: Undeveloped Land

Brokerage: Conkling Land Enterprises

Brokerage Link: conklinglandenterprises.spread.name/

Nearby Listings